Pawn shops are a financial alternative for many people. Pawn shops work with people of all economic and social class. There are no “certain” people who use pawn shops as a financial option.

In today’s society, many people need instant cash to meet their financial obligations, plan for a trip, or mitigate an unexpected emergency. Customers of a pawn shop represent families in America who periodically experience unplanned, unforeseen needs for short-term funds. Pawn shops provide fast cash.

The pawn industry is attractive because the shops across America are friendly, safe, and confidential. They offer excellent customer service.

All pawn shops must comply with federal, state, and local regulations and laws to remain in business. They also work with law enforcement to ensure that what they take in and sell isn’t stolen. Most pawn shops are located within states, where the shop regularly reports all transactions to local law enforcement.

Pawn Shop History

Pawn shops first emerged in Ancient China to give short-term credit to peasants over 3000 years ago. Pawnbrokers mostly operated independently, and over time the pawnbrokers began running their loans through pawn shops. They would lend on pawn items from luxury items, gold, jewelry, and household goods.

Pawn Shops Pay for Valuable Items Outright and Also Loan Against Valuable Things – What is a Pawn Loan?

Pawn loans are called collateral loans or secured loans. The items brought into a pawnshop are used to secure funds through a short-term loan. Pawning effectively gives you cash, but the process is a bit different.

Top dollar items include gold, precious metals, name-brand tools and electronics, musical instruments, and hard-to-find collectibles. A diamond with a large carat weight will bring more money than a seed diamond.

Pawnbrokers will appraise and authenticate a valuable item brought into a pawn shop, and give a no obligation quote. Items that bring a higher market value will bring higher cash when securing a pawn loan.

The great thing about a pawn loan is that it is a short-term loan, and when the terms of the contract are fulfilled, the item is returned to the owner. This gives a way to obtain cash, but not lose ownership of things with sentimental value.

Pawning Process

The pawnbroker will appraise the item brought in as collateral. As mentioned, the more valuable an item, the more cash a borrower can get.

The pawn brokers will go over the terms of the loan, when payments are due, and what happens when the loan is paid in full. They will disclose the interest rates available, which may be different for different areas and through different pawn shops.

Pawnbrokers lend money on items of value, including gold and diamond jewelry, musical instruments, televisions, electronics, tools, collectives, and more. Some pawn shops may specialize in certain items.

After a customer pays back the loan amount plus the interest rate, the valuable item will be returned to the customer. Sometimes a customer chooses to surrender the collateral as payment in full. When this occurs, the pawn shop places the item on the resale floor to sell for repayment of the money given out.

Different pawn shops will offer different extensions and/or renewals, depending on the state law.

Pawn shops offer consumers quick cash to meet short-term cash needs. The pawn process doesn’t require a credit check or for the borrower to disclose financial information, such as employment history and wages. The entire process is convenient and confidential.

In situations where the loan is not paid back, there is no reporting to the credit bureau or legal consequences. The collateral is retained for sale. Because a collateral loan is a secured loan by a valuable item, the loan doesn’t contribute to bankruptcy or bad credit.

Loan Amounts

Loan amounts are based on the value of the item the customer brings in. State laws govern the maximum amount that can be lent, and the market value is the basis for the amount offered. Loan amounts vary depending on market value, demand, and condition.

How Are Valuable Items Appraised?

Experts complete appraisals in the pawn industry, who work or own the pawn shop. These individuals are known as pawnbrokers.

The appraised value can be completed through different testers, ex-ray machines, and authentication applications. Most pawnbrokers are experts or know someone who is.

Pawn shops base the value of the item on current market value, its current condition, and the ability to sell the item. Pawnbrokers use research tools that they have at their disposal to determine an item’s value and get you the most money for the item. All items are tested to ensure they are in good working order. Pawn shops also consider the resale value of the items they bring into the shop.

Selling Process

Pawning an item is different than selling an item to a pawn shop. Selling is a permanent transfer of ownership from one person to another. If there is sentimental value to a family heirloom or piece of fine jewelry, don’t sell it outright, because to sell is a permanent action.

For example, maybe you have gold jewelry in your closet that you don’t care to retain ownership of, and you need quick cash. Pawn shops are in the pawn business and have retail storefronts to fill with high-value items. They are in the business of buying high-demand items.

Some pawn shops may offer a higher cash value for valuable items sold for immediate cash vs pawning the item. A pawn broker will go over the options before the transaction occurs.

Unlike banks or other financial institutions, pawn shops don’t report financial contracts to the credit bureau or need to know your credit history. The pawning or selling process is secure and trustworthy. Pawn stores offer a fair price on items, because this is how they maintain their customer base.

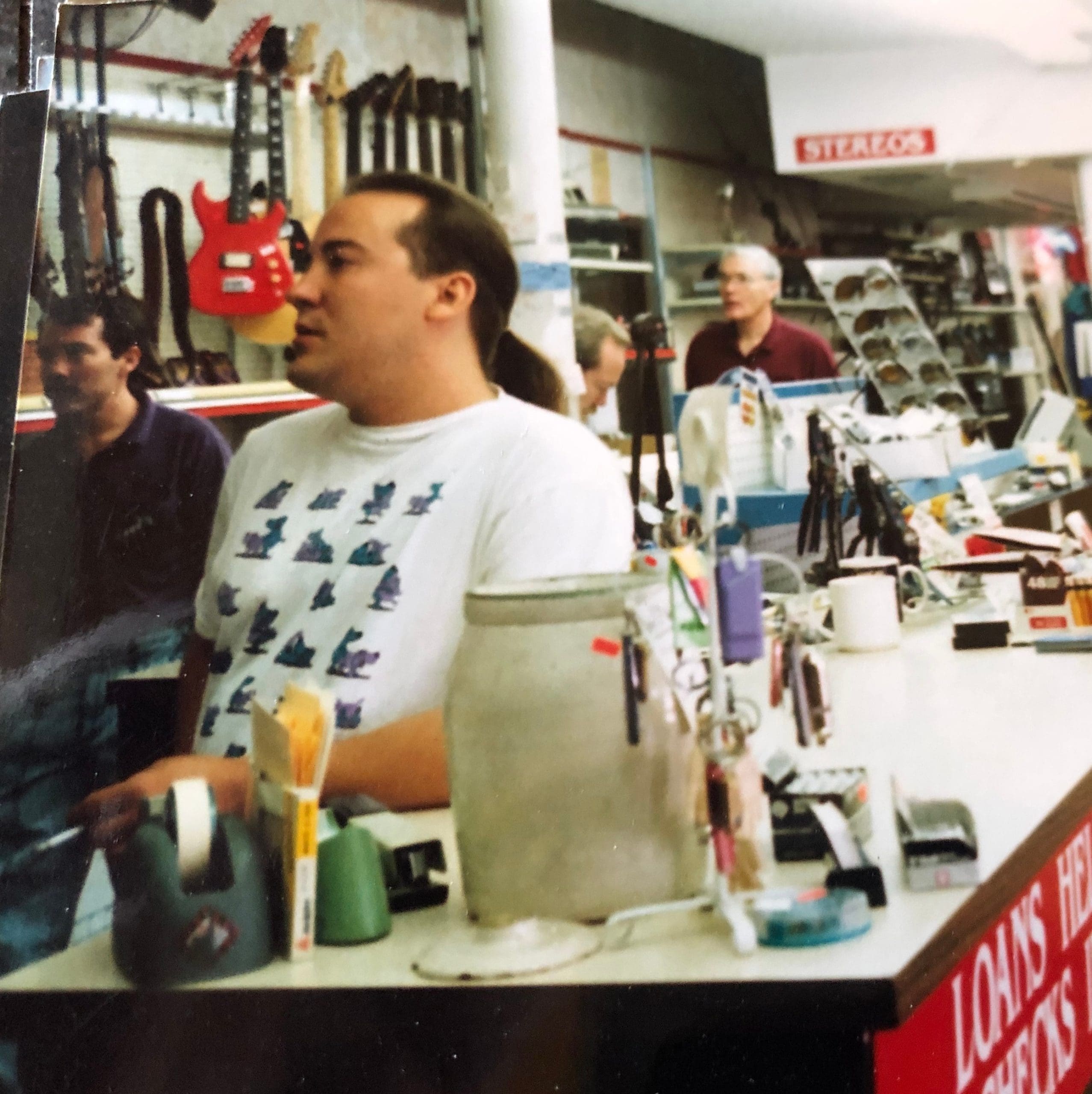

Axel’s Pawn and Gold

Located in Spokane, Washington, the pawn store started as a gift shop until it became a pawn shop. The initial focus of the shop was tools. Since its inception, it has had a reputation of a trusted family owned shop.

Serving the communities in and around Spokane, Washington Axel’s Pawn has everything from A-X. They specialize in tools, gold, silver, and luxury items. Their services are centered on integrity and compassion.

People wonder what is better; to sell or pawn. At Axel’s Pawn and Gold, the pawnbrokers will give advice and choices. They understand that one of the biggest advantages of pawning is that you retain ownership of your valuables.

There is no loan too small or too big for Axel’s Pawn Shop

No one can give you a universal answer to whether you decide to sell or pawn. It is important to understand the difference between pawning for instant cash versus selling. Because Axel’s Pawn Shop prides itself on compassionate interactions with their customers, they are willing to guide their customers through the process so that the right decision is made.

Knowing that you will have an easy transaction process and factors discussed that will ensure top dollar for quality items is why customers keep coming back.

Come in today and see what Axel’s Pawn Shop has to offer.

Recent Comments